This article gives you guidelines on how to price your products, and the typical process used in most companies.

You can read all the articles in our Product Management Journal – Pricing by signing up for free here.

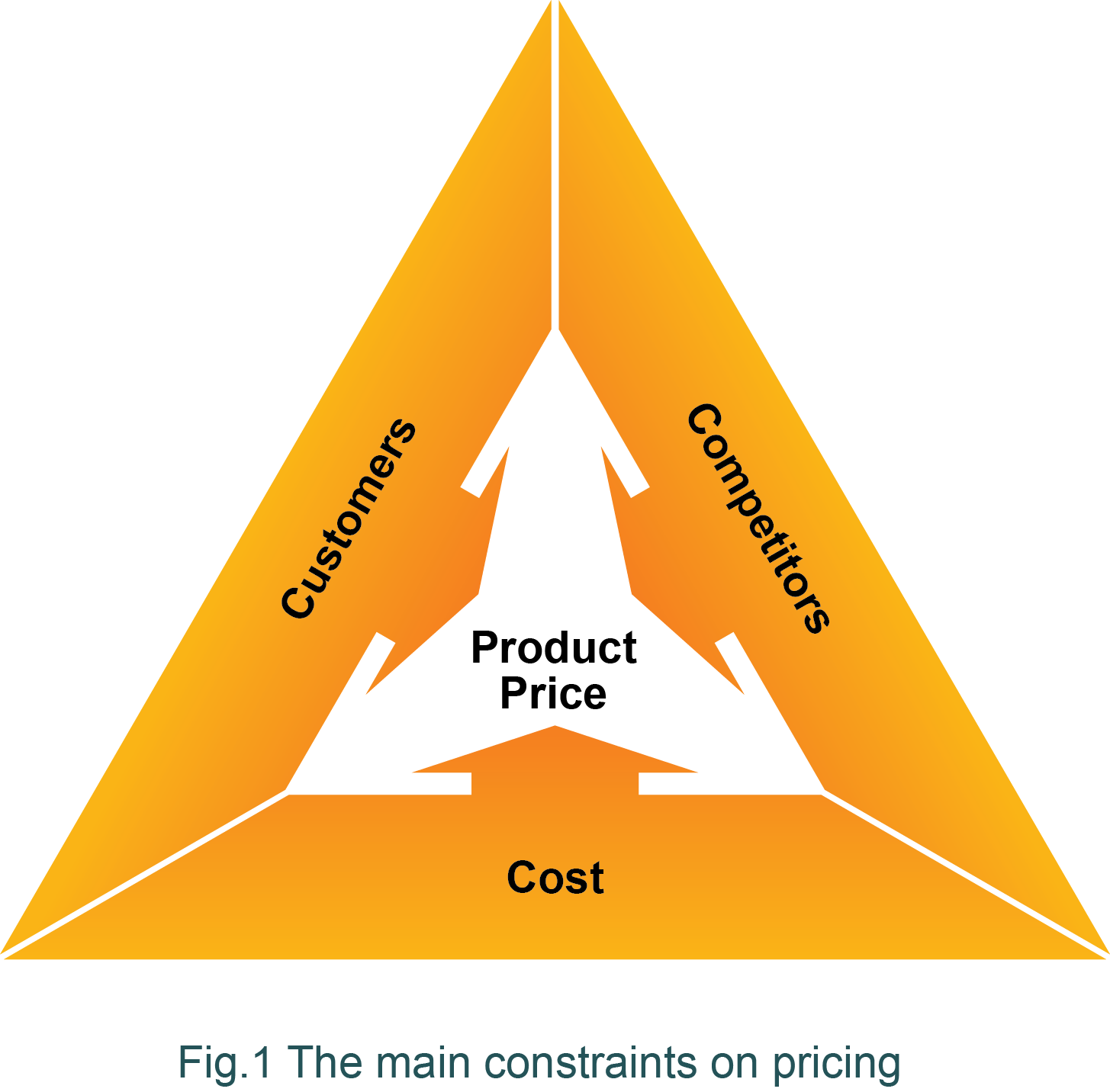

At a basic level, the main constraints on pricing are the costs associated with your offer, customers’ willingness to pay, and your competition (see Fig.1). Product costs set a lower limit below which prices are not viable in the long-term. The upper limit is a combination of affordability for your target customers, how they perceive the value of your product, and how it compares to the alternatives, e.g., your competition.

The pricing cycle

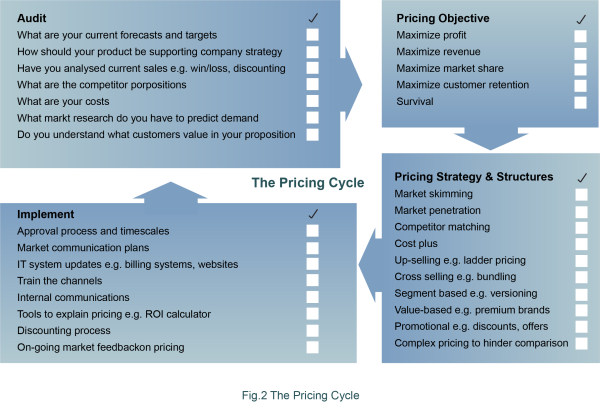

When launching a product for the first time, pricing is one of many topics that has to be addressed. However, the majority of pricing changes are for products that are already in-life, and Fig.2 shows the typical pricing cycle that takes place in most businesses. In some markets, this cycle is spread over many years, and in very competitive markets, sometimes it can all happen in a single day.

At the start of the pricing cycle, an initial audit should pull together all the available data and insights. The pricing objectives should be relatively straightforward and flow from your company strategy. The next challenge is to select one or more pricing strategies and then the appropriate pricing structures and price levels to meet the objectives. In many instances, these will already be well understood, and what’s required is just a tweak to the current pricing levels. Finally, once the pricing has been approved by the business, it must be implemented, and the cycle can begin again.

Choosing a pricing strategy

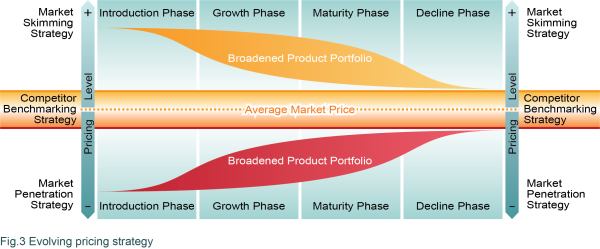

There are 3 basic pricing strategies. Market skimming is setting your pricing high relative to major competitors and is often used if the pricing objective is to maximize profitability. Market penetration is setting your pricing low relative to major competitors and is often used to maximize market share. Finally, competitor matching is setting your pricing at a similar level to the competition and is often used to maximize customer retention.

Market skimming

If you’re the only product in the market or have a highly differentiated proposition but can only supply a small proportion of the market, then a market skimming strategy is often best. This allows you to maximize profitability and use your high pricing to limit demand. However, over time, competitors will enter the market and undercut you. One strategy to defend a high-end proposition is to broaden your portfolio to include offers that also address the lower end of the market. Versioning, discussed in the Pricing Structures article, is a great example of this.

Market penetration

Companies usually adopt a penetration pricing approach because they want to grab market share. However, penetration pricing requires an iron-grip on costs and efficiency, as it is often only with economies of scale that the product becomes profitable.

Another challenge with penetration pricing is its sustainability; customers buying on price are the most fickle. If a lower-priced competitor with a better operational model comes along (or one that is more desperate), your customers may rapidly churn to them. Japanese companies, in the 1980s, took a penetration pricing approach in hi-tech electronics until they were undercut by Korean and Chinese businesses. At this point, their business model had to change to focus on quality, differentiation, and brand development.

Competitor matching

This pricing strategy results in propositions that are priced at similar levels to the competition. This strategy can be most appropriate where markets are only growing slowly or not at all. In these mature markets, any change to pricing can be easily matched by competitors resulting in minor shifts in market share and profit reduction for all. A competitor matching pricing strategy is said to result in a more stable market for everyone. This pricing strategy may also be best for second-tier competitors who can align with a strong market leader; for example, second-tier competitors without a significantly differentiated offer will price slightly below the leader.

Each of these 3 pricing strategies has its merits, and choosing the appropriate one depends on your pricing objectives, where your product is in its lifecycle, and how differentiated your proposition is. Pricing strategy usually evolves during the lifecycle of a product category with a tendency toward the average price as markets mature and move into decline (see Fig.3).

Other pricing strategies and structures

These include up-selling, where customers are persuaded to buy a more advanced option, cross-selling where customers are persuaded to buy additional products in the portfolio (e.g., bundling) and segment-based pricing where pricing is varied based on different customer segments (e.g., students, employed, people over 60).

Telecoms operators in mature markets often use price complexity to make it difficult for customers to compare offerings with the competition. Supermarkets often use a promotional pricing strategy with a constant set of special offers and discounts.

Cost-plus pricing is where an ‘open-book’ approach reveals a supplier’s costs, and a fixed profit margin is agreed with the customer. Although rare, it is seen in some professional services and government contracts.

Value-based pricing

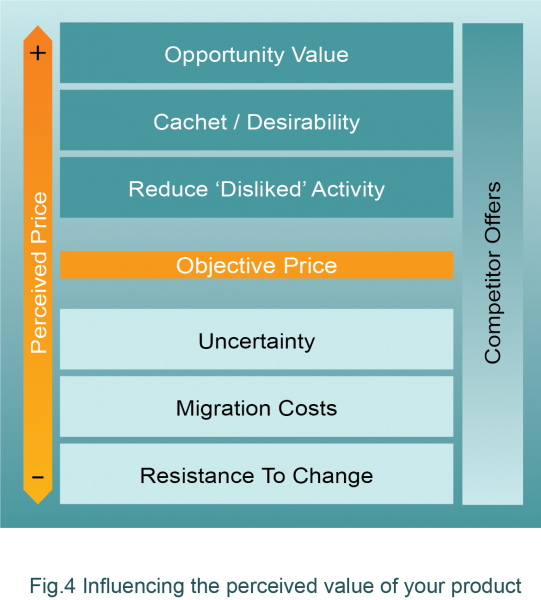

The ultimate pricing strategy is often considered to be value-based pricing. Here the goal is to maximize sales based on the value customers get from your proposition. The challenge, however, is understanding what customers value and how much they value it. Let’s take a simple example of customer value. Your proposition enables a customer to save 10 hours per month. They are paid £10 per hour, giving an annual saving of £1,200. Call this the ‘Objective Price’ for your proposition. The value that customers perceive is affected not only by the objective price but by several other factors, as shown in Fig.4.

Within your product category, customers will view your price relative to competitor offers. They will take into account relative market position, as well as the value of features included, or excluded from each alternative to get to a price they perceive as fair.

Factors that can allow you to charge more are the opportunity value your solution creates, e.g., a solution that frees up valuable time. The brand image of a product might carry desirability that allows pricing far beyond the intrinsic value of what is being purchased, e.g., designer clothes in the fashion market.

There are also significant downward pressures that will affect customers’ perception of your price. Migration and setup costs have to be added in by the user, which may make them want to pay less. People also have to overcome their uncertainty and inertia before they’ll consider buying, and companies typically use price promotions to encourage customers to make a quick decision, e.g., ‘buy while stocks last’. Many companies also offer free trials of products so customers can experience the value before they make a decision to buy.

Implementing the pricing strategy

Having a good understanding of what customers value in your proposition and establishing a price is only half the battle. It can be easily undermined by ineffective implementation.

By this, we don’t just mean implementation on IT systems but ensuring adequate training and tools to support all touchpoints where pricing is discussed with customers. This not only means your direct and indirect sales channels but also getting buy-in from senior executives that might get pulled into pricing negotiations. Establishing and holding a pricing strategy requires a consistent understanding and communication of the pricing and proposition delivered by these key staff to customers.

As a product manager, you need to ensure regular feedback from the market to monitor the effectiveness of your propositions and pricing. Pricing strategies need to change during a product’s lifecycle, and key indicators that a review is needed include declining market share, discounts failing to drive growth (or becoming the norm), and competitors introducing new offers, or aggressive new pricing.

If you work with a pricing specialist, ensure you have a good working relationship and regular communications, so you can share pricing issues and ensure they understand what customers value in your product.

Conclusion

As with many aspects of product management, understanding your competitors, your real customer needs, your position in the market, and your company’s strategy are the fundamentals on which your price should be built. You should not underestimate the importance of optimizing pricing and accept that the pricing cycle with regular pricing reviews and adjustments are an important part of your role. Good luck!