Three years ago, AI tools felt like novelties. Today, they’re reshaping how product managers research competitors, synthesize feedback, and size markets. This guide breaks down where AI can help, and where human judgment remains non-negotiable.

Tools like ChatGPT keep rewriting the rules of how we work, think, and build products. Tasks that once felt impossible now happen in a click. Workflows that used to feel like slogging through mud are suddenly smoother, sharper, and—yep—kind of fun.

This blog is a guide through that shift for Product Managers.

⚠️ Before using AI at work, check your company’s AI policy. Most employment contracts restrict sharing confidential information externally, and even opting out of model training in tools like ChatGPT or Claude may still put you in breach if sensitive data is shared outside the company. If no policy exists, this is also an opportunity. Product and technology professionals are often the heaviest AI users, and you may be well placed to help shape a policy that enables safe, responsible use.

Worth noting: overly restrictive AI policies can increase risk. When people feel blocked, they tend to use AI anyway, just without guardrails or guidance. The goal is balance, to protect sensitive information without shutting down the tools that help people do better work.

Competitive Analysis:

Ideally, you review what competitors are doing each month. Where are they positioned? What have they launched? How is their strategy evolving? This work is important but rarely urgent and day-to-day firefighting often pushes it aside. Six months pass without a proper competitive review.

Deep research is about configuring AI to read hundreds of sources rather than skimming ten. It’s useful but remains underused by product managers. Instead of a quick scan of search results, tools like ChatGPT or Gemini can spend time reading hundreds of websites to surface richer competitive insights.

Here’s a prompt structure you can adapt. You can also use AI to help craft the prompt itself, since each tool responds differently and tends to know what works best for itself, it’s an example about food supplements:

| Example Prompt: You are conducting competitive intelligence research for a UK food supplements company. Our product: "Premium omega-3 supplements targeted at over-50s", "Plant-based protein powders for fitness enthusiasts". Our target market: "Health-conscious consumers aged 35-55 in the UK” Please identify our top 10 competitors in the UK food supplements market and for each one, research and provide: 1. Company Overview - Company size (employees) - Revenue (or funding if private) - Founded date - Distribution presence (online direct, Amazon, high street retailers, health stores) 2. Market Position - Primary customer segment(s) they target (age, health goals, lifestyle) - Price positioning (premium, mid-market, value) - Brand positioning (clinical, natural, performance, wellness) - Go-to-market strategy (D2C, retail partnerships, subscription model) 3. Product Strategy - Core product range (vitamins, minerals, protein, specialty formulations) - Key product differentiators (ingredient sourcing, formulations, delivery format) - Certifications (Informed Sport, Vegan Society, Soil Association Organic, etc.) - Recent product launches - Claims strategy (approved health claims vs lifestyle marketing) 4. Strengths - What they do better than others - Competitive advantages (supply chain, formulations, brand trust) - Strong market signals (customer reviews, repeat purchase rates, retail expansion) - Notable partnerships or endorsements 5. Weaknesses - Gaps in their product range - Customer complaints (Trustpilot, Amazon reviews) - Price sensitivity or value perception issues - Regulatory issues or claim challenges 6. Strategic Direction - Recent moves (new retail partnerships, category expansion) - Investment in marketing channels (influencers, TV, digital) - Expansion into new segments or demographics - Sustainability or ethical sourcing initiatives - Job postings that signal strategic priorities Focus on UK-based competitors or international brands with significant UK presence. Include sources for key claims. |

If your company permits data uploads, you can include information about your own company for comparison, but only with appropriate approvals from your manager or legal team. The more relevant context you provide, the better the results. A final instruction can ask AI to assess competitive threats and suggest strategies to win. This won’t solve every problem, but it generates ideas worth exploring.

Once research is complete, the tool typically generates a document for review. This document can be re-uploaded later with notes, and you can ask AI to update findings and highlight changes since the last review. This makes staying current much easier over time.

Gemini works well for this because of its strong web understanding. However, reports can run 25–26 pages, including comparison tables and a full source list. Claude, ChatGPT, and Perplexity offer similar capabilities.

Review sources carefully. Low-quality articles or blog posts with limited reach can get picked up and amplified. Even reputable sources occasionally contain odd claims. If something sounds outrageous, check the source.

Don’t abdicate responsibility for validation. AI will make mistakes, it can choose incorrect competitors, or even invent competitors and products that don’t exist. If you’re making product and market decisions based on this information, the stakes are high. The higher the stakes, the more time you need to invest in verifying AI output.

Generated using Gemini 2.5 pro

User Research:

Talking to users regularly is the standard everyone agrees on. Yet in practice, it doesn’t happen. Sometimes there’s no obvious user to speak to, calendars don’t align, or the effort slips down the priority list. In the results from our most recent product management survey, over 70% say they don’t spend enough time with customers.

AI can help a little, but it’s not a replacement for real conversations. Treat it as a practical halfway step when access to users is limited.

Modern AI models are trained on vast amounts of real human discussion. Platforms like Reddit contain billions of conversations about everything from moving house to choosing supplements. That depth allows AI to simulate user viewpoints with surprising accuracy. In property-tech scenarios, synthetic users have surfaced the same frustrations people consistently report when moving home in England.

Creating synthetic user personas is worth experimenting with. Define the scenario and context, then let AI respond from that point of view. In the vitamins and supplements space, for example, AI can articulate how people think, what they worry about, and what influences their decisions. It doesn’t replace user interviews, but it can quickly generate qualitative insight and sharpen hypotheses before speaking to real customers. Feeding in interview transcripts or survey responses makes the output stronger. Here is a helpful template for a prompt:

| Example Prompt: You are acting as Graham, a 56-year-old Logistics Manager living in the UK. You are participating in user research for a food supplement brand. Await my first question once you’ve considered the profile below: Persona Profile: "The Cynical Sceptic" Name: Graham Age: 56 Location: The Midlands, UK Occupation: Logistics Manager (Shift work, high stress). Key Characteristics: - Health Goals: Wants to fix his "dodgy knees" (from years of 5-a-side football) and combat the "3 PM slump." He isn't trying to be an athlete; he just wants to walk the dog without groaning. - Buying Habits: Shops at Boots, Holland & Barrett, or the local supermarket. Will buy online (Amazon) only if he recognizes the brand. - Budget: £30–£45 per month. He views anything more expensive as a "rip-off" unless the results are undeniable. Pain Points: - NHS Wait times: He knows he won't get a GP appointment for minor aches, so he is self-medicating with supplements. - "American" Marketing: He hates over-hyped, aggressive sales tactics. If it sounds too good to be true, he assumes it's rubbish. Voice and Tone: - Dry, understated, pragmatic, short answers. - Attitude: He doesn't want a "journey"; he wants a solution. |

Live voice chat sessions can also work well. Using ChatGPT in voice mode turns the interaction into a conversation rather than a prompt exercise. You can tune prompts to avoid overly polite or optimistic answers, or even introduce a slightly sarcastic tone. That friction keeps the feedback grounded and believable.

Used this way, AI becomes something to think with, a thought partner. Ideas can be tested, challenged, and reframed in minutes. The output isn’t statistically significant, but it’s fast, directional, and grounded in real public discourse.

Customer Feedback Analysis:

The same pattern applies here. Reviews, app store comments, NPS responses, and surveys are rich sources of insight, but are hard to synthesize at scale. Earlier AI attempts often struggled, missing themes or grouping feedback poorly. That has changed over the last few years. AI is now strong at identifying patterns across large volumes of feedback, including content in multiple languages.

Structured data works best. CSV files containing NPS or survey responses can be analyzed effectively with minimal prompt engineering. Recent models can accurately interpret different languages, categorize complaints, and identify trends across products and regions. More deliberate reasoning modes tend to produce noticeably better results than fast or automatic settings.

| Example Prompt: Analyze these 100 pieces of customer feedback tickets from the past month. Tasks: - Translate all feedback to English for analysis - Identify the top 10 recurring issues across all languages - Group related complaints together (even if phrased differently across languages) - For each issue, show which markets/languages report it most - Estimate how many customers each issue affects - Flag issues that appear in one language/market but not others Present findings in English, ordered by impact, with translated examples from tickets |

Market Sizing:

Industry market reports often contradict each other, making it hard to build confidence in the numbers. AI can help by generating transparent assumptions and estimates for Total Addressable Market, Serviceable Addressable Market, and Serviceable Obtainable Market.

In our example, for categories like Omega-3 supplements in the UK, this approach can produce a full model with clear assumptions and summaries. Comparing outputs from multiple models and averaging results improves confidence, especially when paid market reports are unavailable or too expensive.

As with competitive analysis, cross-check and validate AI-generated information. Market sizing guides strategy, which makes it high stakes, so verify before acting.

| Example Prompt: Calculate the market size for premium omega-3 supplements in the United Kingdom, targeting health-conscious adults aged 50-70. Please provide: 1. TAM - all omega-3 supplement sales in UK 2. SAM - premium omega-3 segment for 50-70 age group 3. SOM - realistic market share for a new entrant in year 1-3 For each calculation show data sources, list assumptions, explain reasoning, and provide conservative and optimistic scenarios. Include: market growth rate, key competitors, distribution channels. Produce a complete spreadsheet. |

Stakeholder Management:

AI can help with parts of stakeholder management. Corporate co-pilots can summarize past interactions, generate timelines of emails and calls, and surface transcripts from recorded meetings. This makes preparing for conversations faster and less error-prone, provided company policies are followed and privacy risks are understood.

AI is most effective when handling work that doesn’t require direct human attention. It can help draft slides, presentations, and infographics, freeing time for higher-value thinking.

The risk is abdication. When people hand over simple tasks without adding context or judgment, work slows down rather than speeding up. AI should sharpen decisions, not replace them. Outputs still need to be understood, challenged, and owned; especially when they inform strategy. AI won’t be held accountable for the outcome, but you will be.

The future….

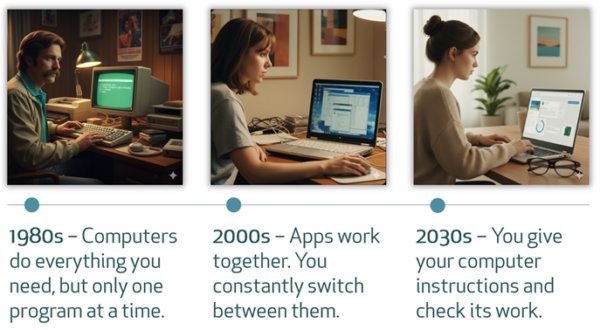

Making predictions is difficult and often backfires, but it’s important to think about possible futures. Looking back, in the 1980s, computers could only run one program at a time; no multitasking. In the 2000s, apps started working together. For example, in the Microsoft stack, you could use Excel, Word, and Outlook together to automate sending personalized emails.

Today, we use AI by copying email threads or chat messages or files into ChatGPT or Copilot, asking it to draft responses, and then pasting them back. That step is redundant. A future model could let AI read the thread, take instructions, draft, and send the email directly. Similarly, AI could handle research and booking tasks for holidays or other projects, executing them autonomously.

The future may involve collaborating with AI rather than only using apps directly. Sometimes we’ll use apps ourselves; other times, we’ll direct AI to use the apps on our behalf. Companies creating websites or mobile apps will need to consider two classes of users: humans and AI.

We’re already seeing early examples: tools like Claude offer connectors to Notion, Jira, and Confluence, mostly for pulling information now, but pushing actions is coming. It’s gradual, and safety measures will initially restrict AI capabilities compared to human users.

Product metrics will also need rethinking. Engagement time may matter less; task completion might become a more meaningful measure. There are new challenges too, like how users will discover new capabilities if AI is the main interface, since conventional UI cues (like Slack’s gift box or red dot) won’t apply.

In summary, we need to consider:

- How AI can remove or take over time-consuming tasks.

- Designing experiences for when users interact indirectly via AI.

- Coexistence with AI initially, but eventually AI could be the dominant way people use apps.

- New policies, trust mechanisms, and measurement approaches when AI acts on behalf of humans.

This article is adapted from our webinar. Watch the entire webinar below.

Leave a comment